Implementing statistical arbitrage strategies in MetaTrader 4 (MT4) and MetaTrader 5 (MT5) requires a deep understanding of mathematical models and algorithms. Here’s a more in-depth exploration, focusing on the key formulas and concepts essential for these strategies.

Statistical Arbitrage: The Core Concepts

1. Pair Trading

- Identification: Choose pairs of stocks, currencies, or commodities that have historically moved together.

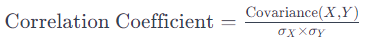

- Formula: Use correlation coefficients to measure how closely the prices of the two assets move together.

- Strategy: Go long on the underperforming asset and short on the overperforming one, betting on their price convergence.

2. Mean Reversion

- Concept: Prices will revert to their historical average over time.

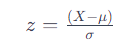

- Formula: Calculate the z-score to identify when to enter and exit trades.

where μ is the mean and σ is the standard deviation.

- Application: A high positive z-score indicates a selling point, whereas a high negative z-score suggests a buying point.

3. Cointegration

- Purpose: Identify pairs of assets whose price series move together in the long run.

- Method: Use the Engle-Granger two-step method for testing cointegration.

- Step 1: Regress one asset price on another and obtain the residual series.

- Step 2: Test the residual for stationarity using an Augmented Dickey-Fuller (ADF) test.

Statistical Arbitrage Implementation in MT4 and MT5

MT4

- MQL4 Limitations: Given MQL4’s simpler nature, implementing complex statistical models might be more challenging.

- Execution: Suitable for less computation-intensive models, as MT4’s execution might be slower compared to MT5.

MT5

- MQL5 Advantages: The advanced nature of MQL5 aids in implementing sophisticated models that require extensive computation.

- Backtesting: MT5’s advanced backtesting capabilities allow for a more accurate simulation of statistical arbitrage models using historical data.

Calculating standard deviation for MT4 Statistical Arbitrage EA

double StdDev_Func(int position,const double &price[],const double &MAprice[],int period)

{

//--- variables

double StdDev_dTmp=0.0;

//--- check for position

if(position>=period)

{

//--- calcualte StdDev

for(int i=0; i<period; i++)

StdDev_dTmp+=MathPow(price[position-i]-MAprice[position],2);

StdDev_dTmp=MathSqrt(StdDev_dTmp/period);

}

//--- return calculated value

return(StdDev_dTmp);

}

//+------------------------------------------------------------------+

double SimpleMA(const int position,const int period,const double &price[])

{

double result=0.0;

//--- check position

if(position >= period - 1 && period > 0)

{

//--- calculate value

for(int i = 0; i < period; i++)

result+=price[position-i];

result/=period;

}

return(result);

}Risk Management and Optimization

1. Risk Management

- Value at Risk (VaR): A statistical measure to assess the level of risk associated with a portfolio over a specific time frame.

- Stop-Loss/Take-Profit: Set these thresholds based on historical volatility and mean-reversion tendencies.

2. Optimization

- Parameter Tuning: Use MT4/MT5 optimization tools to fine-tune parameters like entry/exit thresholds, look-back periods, and position sizes.

3. Model Robustness

- Walk-Forward Analysis: Test the strategy on out-of-sample data to ensure its robustness over different market conditions.

Conclusion

While both MT4 and MT5 can facilitate statistical arbitrage strategies, MT5’s advanced features are more conducive to implementing complex, computation-heavy models. Successful application requires not just programming skills but also a deep understanding of statistical concepts and market dynamics. Moreover, rigorous backtesting, risk management, and continuous optimization are crucial to navigating the challenges of statistical arbitrage in the ever-evolving financial markets.